Don’t Slip Climbing Up The Property Ladder

Are you getting ready to move up the property ladder? By the time you hit the age of twenty, you’ll find that there seem to be numerous people urging you to buy your first home, whether you can afford it or not. It’s important to be aware that not all these people have your best interest at heart. Some people will maintain that renting is dead money and this is certainly true.

However, that doesn’t mean that buying is automatically the best decision. You will still need to approach this challenge the right way and ensure that you don’t rush in. Don’t forget, if you buy property, there’s no easy, immediate way out. One way or another, you’re in this for the long haul. So, let’s look at some of the key points that you need to be aware of before you buy.

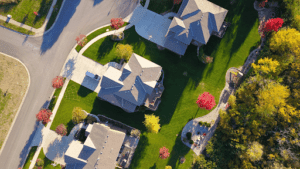

Research The Market

You should definitely make sure that you are researching the market before you commit to making a purchase. You need to know whether it is, in fact, the right time to buy and whether it’s a good time for the area where you’re looking at a home.

You should also have a strong idea of how much you are going to need to pay for a property. Be aware that some sellers are going to be attempting to sell their property for a lot more than they are actually worth.

There are good and bad times to buy a home. A bad time will be when the housing market is healthy. If that’s the case, then buyers will be able to get away with selling their homes at higher prices. If the housing market is a little dicey, buyers will have no choice but to cut the asking price down by a considerable amount. So, it can definitely be beneficial to you if you can wait for a point like this in the market. If that’s not an option, then you should at least check that you are buying the right property for you.

Assess The Property

Determining whether you have found the right property will require you to assess it carefully. It’s important that you don’t end up with what is commonly referred to as a money pit. A money pit home is a property that has so many issues you’ll have to pour a fortune into fixing it up the right way, however, you can. This could be because the home has structural issues.

Alternatively, it’s possible that the property has problems that a previous buyer has left behind. For instance, it might be the case that the home has a pest infestation. Issues like this are the reason why you should always complete a full survey of a property before you commit to purchasing it yourself.

Now, it’s worth noting that surveys aren’t always accurate which is why if you can afford it, you might want to complete two from two separate companies. This can be worth it in the long run, particularly if you are investing in a second home. You can learn more about this other type of property purchase on OnTheMarket.Com.

Don’t forget, it’s not just the property itself that you need to think about when you are completing your research. You also need to explore the area as well. It’s important to know whether money is being injected into this location and if it has a solid support infrastructure.

Get Your Finances In Order

Next, you should consider how you can improve your financial situation. There are numerous ways to do this however before you get started, you should know why it’s important. When you buy a property, you are always going to need to take out a loan. Very few people have enough cash in hand to afford a property outright, unless of course you have inherited a lot of money. This means that you are going to need to rely on the support of a lender. Lenders such as these wholesale mortgage bankers FLORIDA can provide a great deal on a mortgage. But they will only do this if you think about two key factors carefully.

First, you need to make sure that you are saving enough money for a deposit. That’s easier said than done. Second, and perhaps more importantly, you need to guarantee that your credit score is healthy. There are lots of resources that can help you with both these targets such as Pigly.Com. Using this service you can check exactly how much you need to pay each month to get your finances back on track. You might also want to think about how long it’s going to take you to save before you can afford to buy the right way.

Make The Right Improvements

Finally, you need to make sure that you are making the right changes to the property. You must think about how to make changes that are going to add value. If you don’t do this, then you could end up with a shortfall when it’s time to sell. This essentially means that the property is worth less on the market than the mortgage that you have paid into it. It can be a very rough position to find yourself in.

By making the right changes and renovations to your property, you can guarantee that you don’t end up in this situation. Some of the changes that are worth exploring include kitchen and bathroom redesigns or even full extensions. Be aware that there are lots of ways to alter the perceived value of the home. However, very few changes will impact the real value of the property. To do this, you need to think beyond what a buyer is going to want and instead make the home radically different. Solar panels are a smart choice and will benefit you while you’re living there as well.

We hope this helps you understand the key points that you do need to think about when you invest in property. If you take the right steps here, then you can guarantee that your purchase is a tremendous success and that it doesn’t leave you in a difficult financial situation.

17 Comments

Tamra Phelps

Remember about a decade ago or more when so many people bought homes that it turned out they really couldn’t afford based upon what seemed like a doable monthly payment? I always think about that if I think about buying a home. You have to consider all the ways a home has to be kept up, insurance, how you want to live and what that really costs, etc.

Kate Sarsfield

To follow on from my previous comment: Here I am on the other side of the country!

Tamra Phelps

Well, I guess this isn’t likely to be my problem any time soon, lol. But I’d love being able to buy my own house someday.

Kate Sarsfield

We’ll be selling the family home soon so I’ve been researching house prices. I certainly can’t afford anything around here. I want to buy. In Ireland you can’t get long leases, so there’s never the security or peace of mind. Lots of landlords don’t allow pets. At almost 62 all I need is a small home that’s structurally sound, has a garden and broadband and if I have to move to the other side of the country to find it then that’s what I’ll do!

Kelly O

I was “pressured” to buying my first home. The idea of “throwing money away on rent”. Although it did end up being an investment that paid off, it could have gone really bad. Owning is full of unexpected expenses. It can cost a lot to own. The idea of home ownership is not for everyone.

Lisa DT

Can’t I get only one guy or woman who can give an honest appraisal. There are so many to ask.

Brandi Dawn

Very good tips. I am in my 40’s and have never purchased a home. I just didnt want to be tied down to any one location. Now that my kiddo is off to College I am considering maybe sticking around in Colorado for a while.

Calvin

Great insights, always good to rethink the goals.

Rosie

I’d add to be very careful with condos. Find out how much they have in reserves, what has been done to keep up on large projects that they may not have the money for, such as roofs, new decks, boilers, on and on. See if the board seems robust, or is it falling apart. You may be able to tell some of these things if a couple of years’ worth of minutes and budgets are in the resale package. Are a lot of people suddenly selling in the complex, there may be a pending change to the condo docs that could impact whether you would buy or not. Are they considering to change their pet policy, and it may currently allow (or not) pets, and if it is important to you, you may need to look further than the Realtor sheet that says “pets allowed.”

Dawn Keenan

We bought our first home when I was 23. Since then we have moved 4 times. We were very careful and fortunately never lost money on any. Research is the key!

Nathaniel

As with anything doing your homework pays dividends.! Thanks for the help!

Sarah L

Lots of things to think about. I waited until I was 40 to buy my house. It’s now paid for.

Leela

It’s so hard to sell right now. We just need to move.

Renee T

Great tips. You can lose a lot of money in the housing market.

Tamra Phelps

So many people watch the home improvement shows, see people flipping property, and think it’s easy. I’ve seen friends do it and it’s not easy…you can lose a lot if you don’t do it right. These tips would help a lot of people.

Dana Rodriguez

Great tips. You def need to research!

Kelly Kimmell

These are all wonderful tips to keep in mind.