Debt! Now THAT Is A Topic To WHINE About!

Time is a funny thing. I don’t know about you but when I was 15 getting to 16 took FOREVER!! Then 18. Holy Guacamole Batman time seemed to crawl. 21? Forget about it.

By the time I was 21 I already had two little ones and trying to make ends meet. I tried all the tricks like sending the phone bill payment to the electric company. (APPARENTLY in the 80’s this was common, cause they caught on QUICK!) I clipped every single coupon I could find. Then someone thought it was a great idea to give ME a credit card!??! (Pfffftttt that was dumb!)

I obliged their generosity by shopping, shopping, shopping. At that time my parents were my way to get my finances back on track, they were pretty understanding (OH IF ONLY my Mom were alive to read that line!) They were ANGRY! However, they helped me get out of that deep, dark, expensive hole. (I’d like to add that I only had a $500 limit at the time. But it was mountainous to the 21-year-old me) Ya know that interest is what kicks you while you are down. I just could NOT get my finances back on track! (BTW your parents will PROBABLY only bail you out once. Just sayin’ from my experience.)

Then when the kids were older the credit card limit was higher and Zachary was growing a the speed of light. I swear I couldn’t keep that kid in SHOES!!! Then pants? I mean I would buy jeans for the kid at the beginning of the school year and buy them several inches TOO LONG and by Christmas they could pass at capri’s. (You can NOT convince a 16-year-old boy that capri pants are all the rage in Paris. He ainte buyin’ it!) Add in a mortgage. Cars. Toys. (something shiny I HAD to have!?!)

Christmas. I can’t possibly be the only parent out there that doesn’t overdo it at Christmas. (CAN I??) We all want to shower our sweet babies with presents. (Even at age 13, when I feel they should be sent to an island Lord of The Flies style until they are human again!) I try and give my kids that wonderful Christmas memory. It’s what I do.

Then retirement hits. WAIT A MINUTE!! I swear to you! I just turned 30! What the HECK!?!?

Retirement is AWESOME!! Seriously, as long as you are careful. Because if you don’t keep your finances on track, you won’t be retired long. As a matter of fact, The Husband informed me that if I accrued any debt, I would have to get (I’m sorry for the foul language here) a JOB! Wait, so HE would be home all day doing whatever he wants to?? Then I’d go to work?! NO! Let me tell ya, even my parents yelling at me did not have the effect that did simple statement had on me. (YOU know he would go downstairs to my craft room and TOUCH MY STUFF!!! WE ALL know he would!!!)

I know that retirement isn’t in the cards for a lot of people. Corona set us back BIG TIME. Now with gas prices? FOOD prices, I seriously commend parents today. I don’t know how you do it. I truly applaud you.

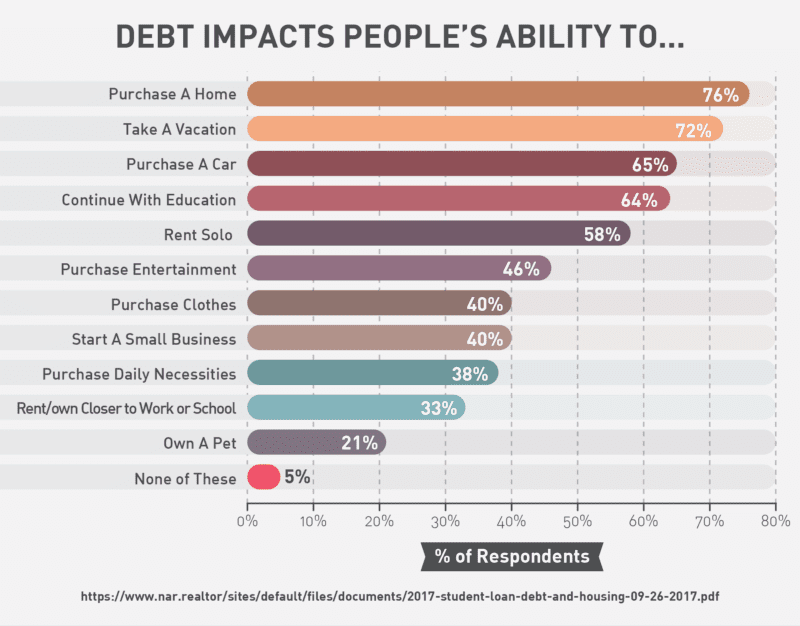

Debt affects in ways I hadn’t thought of. Check this infographic:

Understanding your debt is probably a good first step. Understanding the triggers, helps you to understand the TERMS!! Which I wish I would have understood at the beginning of my credit adventure. (didn’t that sound like a better term than the deep, dark hole I couldn’t seem to get out of?)

Now you can search the Internet and read, read, read. For instance, the FTC has a great article you can read here. There are also attorneys that can help you legally

Sometimes the next step is getting help, check out this link for some solid completely doable steps (EVEN if you are credit challenged like me).

Sometimes that debt is so overwhelming, it’s necessary to take the next step and speak with a bankruptcy attorney. Each state has some highly qualified attorneys. If you are in Phoenix Arizona click here, otherwise a quick google search will send you in the right direction.

6 Comments

gloria patterson

Totally understand way back when my first job paid $1.25 hr…………………….. but then again prices were a lot lower. I remember having to go to my mother a couple of days before payday and writing her a check for $10 or $20 dollars and asking her to hold the check till my payday. i finally got a credit card but they only time I used it was for a surprised expense. And today if I charge something I pay it off quickly

Karen R

I accrued a lot of debt in my twenties. Debt collectors would call. My Mother said, “You can’t get blood from a turnip”. It didn’t make sense to me. I slowly made payments on my debt. I vowed never to have that much debt, again.

Connie The Head Peanut

Thank you. Trust me I am cured! I’m not going back to work!

Tamra Phelps

Who are those 5% of people who are not affected in any way by debt??? I want to be one of them, lol.

Connie The Head Peanut

RIGHT?!?! MAYBE! They will be our friends?? Or adopt us?

heather

I really enjoyed reading this post and it make me laugh out loud. Credit cards are pure evil and I will never ever have another one by choice!!!!