How Do You Determine The Price Of A Commodity?

Commodity prices are often erratic. This is because there are many factors that affect the demand and supply of a commodity, and thus affect the price too. This article aims to add further clarity to what these factors determining commodity pricing are in order to give everyone a basic understanding of how the market for commodities works.

What is a commodity?

Before delving into what these factors are it’s crucial to establish what a commodity is. Some prime examples of commodities include;

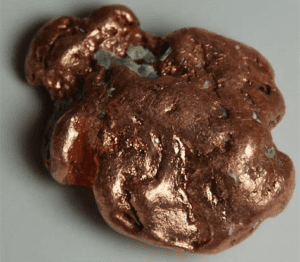

- Copper

- Crude oil

- Wheat

- Iron ore

- Coffee beans

- Gold

In economic terms, you can easily differentiate a commodity by labeling it as an asset whereby if depletion occurred there would be a monumental impact on the world and the growth of specific countries.

Let’s use Chile and the production of copper as an example. Chile has control of approximately 20% of the global copper reserves. If the scarcity of copper arose the country would be in a troublesome situation. The export revenue is crucial to Chile’s growth, with companies around the world using global freight transportation to capitalize on Chile’s copper reserves. So, countries around the globe would suffer too. After all, the import of this metal is needed for everything from power generation and industrial machinery to building construction and transportation vehicles.

Let’s use Chile and the production of copper as an example. Chile has control of approximately 20% of the global copper reserves. If the scarcity of copper arose the country would be in a troublesome situation. The export revenue is crucial to Chile’s growth, with companies around the world using global freight transportation to capitalize on Chile’s copper reserves. So, countries around the globe would suffer too. After all, the import of this metal is needed for everything from power generation and industrial machinery to building construction and transportation vehicles.

Factors determining commodity pricing

Commodity pricing is controlled by the powers of demand and supply. There are other factors that have an impact, such as investment funds and government policies. Nonetheless, their impact is not as significant as demand and supply. They still need to be considered substantially when expert analysis and forecasting takes place though.

Understanding how demand and supply has led to volatile pricing

Understanding how demand and supply influences price is easy. If demand increases/supply falls, the price of the commodity will rise. If demand falls / supply increases, the price of the commodity will fall. The key lies within determining why these shifts in demand and supply occur. Let’s look at a few examples…

- Unpredictable events – This encompasses everything from wars to the weather. An unforeseeable event can have a drastic and instant impact on the price of a commodity. Moreover, because of the unpredictable nature, the result is often more damaging as panic arises as well.

When it comes to the weather, it’s pretty self-explanatory; soft commodities (namely agricultural) can take a huge hit.

When it comes to war, a crisis in a particular area can lead to shipping routes being blocked and alike.

The crisis in the Cote d’Ivorie is a great example. The country is the largest producer of Cocoa, and during the country’s grave political conditions the prices rose to the highest level they had ever been.

- Regulations – Laws and regulations can be put in place and restrict the supply of certain commodities. A prime example of this is the diamond industry. The Kimberley Process has seen supply fall substantially.

- Market conditions – You only need to look at the changing commodity pricing during the global crisis to note how market conditions have an impact. In fact, a great example showcases how in early 2009 the demand for crude oil dropped monumentally because of the worldwide recession. The price dropped to approximately a fourth of what it was prior to this.

These are three of the main factors influencing the demand and supply of a commodity. Aside from this, you have seasonal variations, for example, oil needed for heating rises dramatically during the winter months. Packing to deliver products, don’t forget you’ll need to add labeling supplies as well. Moreover, there are technology changes and human demographics to bear in mind too.

7 Comments

heather

I would love to learn more about commodities this post was chalk full of some great informaiton. I am still pretty lost though but thanks for sharing I will have to read it again.

Kate Sarsfield

It just goes to show how volatile the global economy is, doesn’t it? Look at the effects of Russia’s invasion of Ukraine on fuel supplies & cost; the price of wheat & sunflower oil has soared as well as Ukraine’s harvests have been lost.

Connie: The Head Peanut

We are in a very sad state right now.

Kate Sarsfield

Climate change is another factor to take account of when looking into staple crops.

Crystal K

Thanks, this is a helpful primer, especially because we’ve been considering investing in gold since our retirement funds lost so much during the pandemic.

Connie: The Head Peanut

This pandemic has played havoc with our investments as well.

Tamra Phelps

I’m so clueless about these things. I know that for awhile copper was so valuable that thieves would break into people’s central air units because it had a little copper. That’s the end of my knowledge, lol.