Why You Might Want To Consider Releasing Equity From Your Home

Releasing equity from your home is a hot topic lately. Owning your own home is one of those watershed moments in your life that tells you that you’re doing OK. When we first move away from our parents, many of us do so on a rental basis. It’s a few years later that we buy our first property – often shortly after we’ve settled down into a long-term relationship or got married. Our homes are our security, and a house we own is a place we’ve decided to stay for the long term and put down roots.

If you’ve saved, sweated, and sacrificed for years to pay off the mortgage on your home and own it outright, you’re probably very proud of yourself. You’re also probably feeling less financially stressed than you used to! For many people, mortgage payments are the single largest expense we deal with every month. Once the mortgage is paid and that financial commitment is gone, our monthly expenditure drops. That means more money to spend on the things we like!

For the above reasons, the idea of then charging a debt against your house again so you can release equity from it might sound counter intuitive. Why would you want to do that when you’ve worked so hard to pay it all off – and wouldn’t you be burdening yourself with future repayments? Actually, there are several reasons – many of them positive – and it doesn’t work like a regular mortgage. That often means no monthly repayments at all!

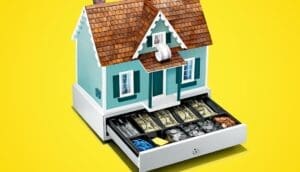

What Does Releasing Equity From Your Home Mean?

To put it simply, an equity release is a reverse mortgage. You’re selling part of the value of your home back to a bank and continuing to live in the home. The key difference is that you’re not paying the mortgage this time – the bank is. In return for a share in your property – which can be as little as 10% or as much as 75% – the bank will give you a lump sum of money. You aren’t usually required to repay that money until you sell the house or pass away. The interest due against the loan is charged against the remaining equity in your house, and so the amount of your home the bank owns will gradually increase over the term of the mortgage.

When equity releases are put to good use, they feel like money for nothing. You don’t lose the ownership of your home, and you don’t have to add anything to your monthly outgoings. You simply take the money and do as you please with it. There are obvious disadvantages – for example, the diminished value of your estate if you pass away with the loan still owing – but if such factors aren’t a concern to you, an equity release can have far more benefits than disadvantages. More people than ever before are turning to equity release mortgages as a way of improving their lives, and here are some of the reasons why.

Credit Repair

A bad credit rating can seriously impair your ability to take on new loans, switch credit cards, or take on a new mortgage if you wish to. It can even affect you in smaller ways, like preventing you from being able to take on a cellphone contract. Banks look at lending as a gamble, and they won’t lend to you if they think the odds of you paying them back are no better than what they’d get if they put their money into a mobile slots game or related casinos. Bankers get excited by a mobile slots win just like everyone else does, but they like a degree of reassurance when they part with a large sum of money! Big banks lending out money like they were playing mobile slots is what caused the financial crash of 2008. They’re a little more cautious these days.

If you’ve been struggling with credit commitments or sinking into your overdraft further and further each month, it will begin to impact your credit rating. Releasing equity from your home could pay all your credit commitments off in one fell swoop and leave you with more of your own money to spend each month. Your credit rating would be better, and you’d be less burdened by monthly repayments.

A Living Inheritance

Increasingly, children don’t want or need to inherit their parents’ homes after their parents have passed away. While it may have been the case that a home would pass from parent to child a century or two ago, it isn’t the case today. Presuming you live a long life, by the time you pass away, your child will likely have a paid-for home of their own. They might not want to inherit your house and move into it. That means they’ll likely just sell it and pocket the money.

If they’re going to do that anyway, then why wait? For many people, watching their children and grandchildren enjoy their financial gift is the source of great joy. Your gift might even be the deposit they need to buy their first home. It might be a once-in-a-lifetime vacation for the whole family. It could even be the start-up funds they require to set up a new business. It’s likely the money would mean more to you and them if you were around to see what they did with it, and to be proud of them.

Funding Your Own Retirement

If you’re lucky, you’ll get a pension when you retire. If that’s a few years away yet we wouldn’t want to turn that statement into a guarantee – given the precarious state of the world’s economy, nobody knows what things might look like in 20 years! Even if you do get a pension, though, it’s the same amount month in and month out. Without bonuses or similar lump sums, that can make it a little hard to make larger purposes.

A reverse mortgage could provide you with a lump sum to improve your quality of life. That might be improvements around your home, funds for a vacation, or just a little more money to spend on yourself. You’ve spent so many years putting money into your house – why not let it put a little money back into your life?

If you’ve never thought about equity releases before, we hope this little guide has been useful to you. Please remember that nothing we’ve said here constitutes qualified financial advice, and that you should always speak to a professional before making any decisions regarding equity in your own home. Thanks for stopping by!

8 Comments

Tamra Phelps

Overall, I’d say just be sure you’ve really thought over the pros and cons. Then make the decision that’s right for you.

Crystal K

Good advice – as you said, often kids don’t want to inherit parents’ homes. I want my parents to spend and enjoy their retirement without worrying about what they will leave to us kids!!

Tamra Phelps

I can see why older home owners would do it to make life easier if they’re having trouble making ends meet. It might be a good idea then, but I can see how it could be a horrible decision if the situation turns out like it has for Kate’s parents. It shouldn’t be done without serious consideration.

Rosie

It is an option, but primarily recommended for seniors with no mortgage and no other means to make do. It is something to consider if you are let go from a job before you can retire, for instance, age 60. If you are in a condo, the complex has to be approved with an expensive application, and most complexes won’t spend the money, but might allow you to pay for it. I had looked into it for an 85-yr old woman at my complex facing foreclosure, but she would not have qualified due to having a large amount till due on her mortgage.

Kate Sarsfield

It was the worst decision my parents ever made! It means the house must be sold once Mum dies in order to pay back the loan and at the time, this made economic sense but house prices & rentals have gone through the roof so unless I can manage to pay it back myself (by cashing in my pension or winning the Lottery) then I’m going to struggle to find anywhere to live.

kiran

Thank you so much for share your thoughts

Tamra Phelps

Well, I accidentally hit my brother’s name on the autofill when I commented above, lol. So, this is me commenting again!

Robert Phelps

It is a good idea if you need the money. Why not use it while you’re here?